Le 24 juillet 2017

Les résultats du deuxième trimestre 2017

Au deuxième trimestre, Philips a réalisé un chiffre d'affaires de 4,3 milliards EUR, avec une croissance de 4% sur base comparable. Le résultat net provenant des activités poursuivies a atteint 161 millions EUR, notamment grâce à une hausse de 15% de l’EBITA ajusté à 439 millions EUR.

Chiffres clés du deuxième trimestre Frans van Houten, CEO: Au deuxième trimestre, nos activités Personal Health ont une fois encore livré d’excellents résultats, avec une croissance du chiffre d'affaires comparable de 6% et une amélioration de la marge EBITA ajustée de 120 points de base. Dans un contexte de faiblesse des marchés, nos activités Diagnosis & Treatment ont enregistré une solide croissance du chiffre d'affaires comparable de 3%, une forte croissance du carnet de commandes et une hausse opérationnelle de 80 points de base. Nos activités Connected Care & Health Informatics ont enregistré une hausse de la marge EBITA ajustée de 90 points de base. Vu le carnet de commandes bien rempli, je suis persuadé que les résultats de ces activités vont encore s'améliorer au second semestre. Au deuxième trimestre, nous avons étoffé notre portefeuille avec une série d'acquisitions ciblées planifiées ces deux dernières années. Pour consolider encore notre position de chef de file avec nos activités Image-Guided Therapy et agrandir le portefeuille de systèmes thérapeutiques, nous avons ainsi conclu un contrat pour l'acquisition de Spectranetics, leader de marché dans le domaine de l’intervention vasculaire et des solutions de lead management. Par ailleurs, nous avons racheté la startup américaine CardioProlific. Cette entreprise met au point une technologie de thrombectomie pour le traitement des pathologies vasculaires périphériques à l'aide de cathéters. Je suis satisfait de l’évolution des diverses initiatives lancées en vue d’une croissance autonome, notamment l'autorisation accordée par la FDA à l’utilisation en diagnostic principal de notre solution Digital Pathology avancée aux États-Unis. Par ailleurs, nous avons mené à bien la transaction Lumileds et ramené à 41,16% net notre participation dans Philips Lighting. Conformément à notre stratégie d'affectation du capital visant un mix équilibré des investissements dans les débouchés de croissance autonome et externe ainsi qu’une optimisation du bilan et du rendement pour nos actionnaires, nous avons annoncé un nouveau programme de rachat d'actions de 1,5 milliard EUR, qui sera lancé au troisième trimestre. Avec ce programme, nous allons grandement réduire l’effet de dilution résultant des programmes Long-Term Incentive (LTI) de Philips et des dividendes sur les actions. Malgré la volatilité persistante sur les marchés où nous sommes actifs, nos perspectives pour 2017 restent inchangées : nous nous attendons à ce que l'amélioration de nos résultats d'exploitation et de la croissance s’observent plus tard dans l'année, notamment grâce à un carnet de commandes bien garni. Nous avons pris le bon cap pour réaliser nos objectifs de 4-6% de croissance du chiffre d'affaires comparable et améliorer la marge EBITA ajustée d’environ 100 points de base par an. » The 6% comparable sales growth of the Personal Health businesses was driven by double-digit growth in Health & Wellness, high-single-digit growth in Personal Care and mid-single-digit growth in Sleep & Respiratory Care; the Adjusted EBITA margin improved by 120 basis points. The 3% comparable sales growth of the Diagnosis & Treatment businesses was driven by mid-single-digit growth in Ultrasound and Image-Guided Therapy, while the Adjusted EBITA margin improved by 80 basis points. Comparable order intake increased by 7%, with all business groups contributing. In the Connected Care & Health Informatics businesses, comparable sales increased by 1%, reflecting low-single-digit growth in Patient Care & Monitoring Solutions. The Adjusted EBITA margin was 90 basis points higher than in the same period last year. Comparable order intake increased by 8%. Philips’ ongoing focus on innovation through organic and inorganic growth initiatives resulted in the following highlights in the quarter: Cost savings In the second quarter, procurement savings amounted to EUR 61 million. Other productivity programs resulted in savings of EUR 48 million. Capital Allocation As announced on June 28, 2017, Philips will launch a share buyback program for an amount of EUR 1.5 billion in the third quarter of 2017, to be completed in two years. As the program will be initiated for capital reduction purposes, Philips intends to cancel all of the shares acquired under the program. Philips intends to execute part of the program through a series of individual forward transactions, unevenly distributed over the two-year period. In July 2017, Philips made a contribution of USD 250 million to the Philips US pension fund to further improve the funding ratio. This will further decrease Philips’ interest costs going forward. Miscellaneous As previously reported, Philips continues to be in discussions on a civil matter with the US Department of Justice representing the FDA, arising from past inspections by the FDA in and prior to 2015, focusing primarily on the external defibrillator business in the US. Philips Lighting On April 25, 2017, Philips sold 22.25 million shares in Philips Lighting, of which 3.5 million shares were acquired by Philips Lighting and were cancelled. Philips’ shareholding in Philips Lighting decreased to 40.97% of Philips Lighting’s issued and outstanding share capital, down from 55.18% prior to the transaction. In addition, in Q2 2017, Philips Lighting acquired 0.65 million of its own shares in connection with its long-term incentive programs. As of June 30, 2017, Philips’ shareholding in Philips Lighting was 41.16% of the issued and outstanding share capital. Philips continues to consolidate Philips Lighting under International Financial Reporting Standards (IFRS). As loss of control is highly probable within one year due to further sell-downs, Philips Lighting is presented as a discontinued operation in the financial statements of Philips as of the second quarter of 2017. Full details about the financial performance of Philips Lighting in the second quarter were published on July 21, 2017. The related report can be accessed here. Second Quarter Results 2017 - Quarterly Report Presentation Second Quarter Results 2017 - Quarterly Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, July 24, 2017. A live audio webcast of the conference call will be available through the link below. Q2 2017 - Second Quarter 2017 Results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV Click here for Mr. Bhattacharya's CV

« Philips a enregistré de solides résultats au deuxième trimestre 2017. Le chiffre d'affaires comparable de nos activités HealthTech a enregistré une croissance de 4%, principalement grâce à l’Europe occidentale, l’Amérique du Nord et la Chine, et le carnet de commandes a bondi de 8%. La marge EBITA ajustée a gagné de 90 points de base, principalement en raison de meilleurs volumes, d'améliorations opérationnelles et de la productivité.

Business segments

Quarterly Report

About Royal Philips

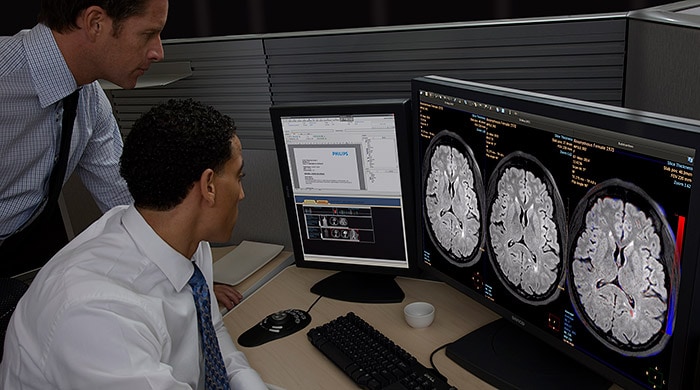

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips' health technology portfolio generated 2016 sales of EUR 17.4 billion and employs approximately 71,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments, including the tender offer for and merger with Spectranetics. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include but are not limited to: domestic and global economic and business conditions; developments within the euro zone; the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; the ability to develop and market new products; changes in legislation; legal claims; changes in exchange and interest rates; changes in tax rates; pension costs and actuarial assumptions; raw materials and employee costs; the ability to identify and complete successful acquisitions, including Spectranetics, and to integrate those acquisitions into the business; the ability to successfully exit certain businesses or restructure the operations; the rate of technological changes; political, economic and other developments in countries where Philips operates; industry consolidation and competition; and the state of international capital markets as they may affect the timing and nature of the disposition by Philips of its interests in Philips Lighting. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2016. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-GAAP information In presenting and discussing the Philips Group financial position, operating results and cash flows, management uses certain non-GAAP financial measures. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-GAAP measures to the most directly comparable IFRS measures is contained in this document. Further information on non-GAAP measures can be found in the Annual Report 2016. Comparable order intake and Adjusted EBITDA are measures included to enhance comparability with other companies. Use of fair-value measurements In presenting the Philips Group financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2016. Independent valuations may have been obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2016, unless otherwise stated. In addition, we have simplified our Q1 and Q3 reporting by excluding the cash flow statement, the statement of changes in equity and certain other tables in the detailed financial information section not required to be disclosed. In our semiannual and annual reporting we will continue to present these statements and tables. Summary cash flow information is provided in the Philips performance section of this document. Prior-period financial statements have been restated for the treatment of the segment Lighting as discontinued operations. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Forward-looking statements