apr 26, 2021

Philips' First-Quarter Results 2021

Philips delivers Q1 sales of EUR 3.8 billion, with 9% comparable sales growth; net income amounts to EUR 40 million and Adjusted EBITA margin improves 390 basis points to 9.5%

First-quarter highlights Frans van Houten, CEO: “Despite the ongoing impact of COVID-19, our performance gained momentum with a strong 9% comparable sales growth and profitability improvement in the first quarter, with all business segments and markets contributing. We are encouraged by the strong 11% comparable order intake growth for the Diagnosis & Treatment businesses, and the strengthening performance of the Personal Health businesses. At the same time, the Connected Care businesses continued to successfully convert their strong order book, while comparable order intake decreased 27%, as anticipated following the 80% order intake growth for patient monitors and hospital ventilators in Q1 2020.

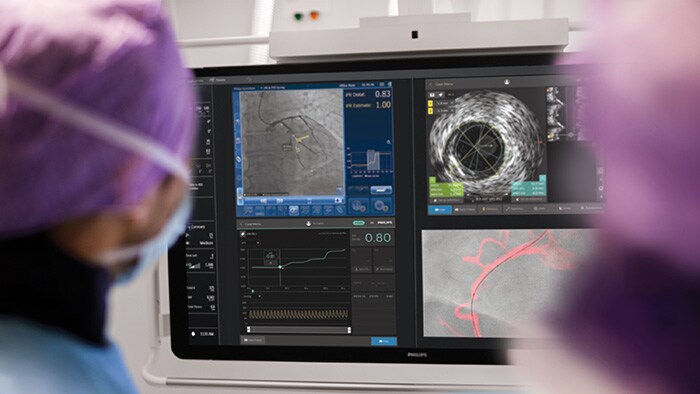

Our growth momentum is driven by our portfolio of innovative solutions, for example in the areas of precision diagnosis, image-guided therapy, and telehealth. Moreover, we continued to add long-term strategic partnerships with hospitals on the back of more than 50 new partnerships we signed in 2020. This illustrates our ability to meet the needs of today’s hospital leaders, across the globe, as they plan for the future.

In line with our plans, we signed an agreement to sell the Domestic Appliances business, which concludes our major divestments. We are pleased that we have found a good home for this business and we look forward to a successful partnership with the new owner, Hillhouse Capital. We are also pleased to have completed the acquisition of BioTelemetry and Capsule Technologies, which will further drive our transformation into a solutions company, and in particular further strengthen our position to improve patient care across care settings for multiple diseases and medical conditions.

Regretfully, we have identified a quality issue in a component that is used in certain sleep and respiratory care products, and are initiating all precautionary actions to address this issue, for which we have taken a EUR 250 million provision.

Looking ahead, while we continue to see uncertainty related to the impact of COVID-19 across the world, we see increased demand in the Diagnosis & Treatment and Personal Health businesses. We now plan to deliver low-to-mid-single-digit comparable sales growth for the Group in 2021 (compared to the earlier projection of low-single-digit growth), with an Adjusted EBITA margin improvement of 60-80 basis points.”

Business segment performance

All business segments delivered comparable sales growth and increased Adjusted EBITA margin in the quarter, driven by sales growth and results of our productivity programs.

The Diagnosis & Treatment businesses recorded 9% comparable sales growth, with double-digit growth in Diagnostic Imaging, high-single-digit growth in Ultrasound, and mid-single-digit growth in Image-Guided Therapy. Comparable order intake showed 11% growth, driven by Diagnostic Imaging and Image-Guided Therapy. The Adjusted EBITA margin increased to 8.7%.

Comparable sales in the Connected Care businesses increased 7%, led by double-digit growth in Hospital Patient Monitoring. Comparable order intake showed a 27% decrease, as anticipated following the steep 80% increase in Q1 2020. The Adjusted EBITA margin increased to 12.8%.

The Personal Health businesses recorded comparable sales growth of 17%, with double-digit growth in Personal Care and mid-single-digit growth in Oral Healthcare. The Adjusted EBITA margin increased to 14.3%.

Philips’ ongoing focus on innovation and partnerships resulted in the following key developments in the quarter:

Cost savings In the first quarter, procurement savings amounted to EUR 44 million. Overhead and other productivity programs delivered savings of EUR 53 million.

Regulatory update Philips has determined from user reports and testing that there are possible risks to users related to the sound abatement foam used in certain of Philips' sleep and respiratory care devices currently in use. The risks include that the foam may degrade under certain circumstances, influenced by factors including use of unapproved cleaning methods, such as ozone [1], and certain environmental conditions involving high humidity and temperature. The majority of the affected devices are in the first-generation DreamStation product family. Philips’ recently launched next-generation CPAP platform, DreamStation 2, is not affected. Philips is in the process of engaging with the relevant regulatory agencies regarding this matter and initiating appropriate actions to mitigate these possible risks. Given the estimated scope of the intended precautionary actions on the installed base, Philips has taken a provision of EUR 250 million.

Domestic Appliances On March 25, 2021, Philips announced that it had signed an agreement to sell its Domestic Appliances business. As of the first quarter of 2021, the Domestic Appliances business (which was previously part of the Personal Health segment) is reported as a discontinued operation. Philips will continue to consolidate Domestic Appliances under International Financial Reporting Standards (IFRS) until the sale is completed. Further details of the restatement have been published on the Philips Investor Relations website and can be accessed here. The Personal Health segment in this report is presented without the results of the Domestic Appliances business. [1] Potential Risks Associated With The Use of Ozone and Ultraviolet (UV) Light Products for Cleaning CPAP Machines and Accessories: FDA Safety Communication

Report First Quarter Results 2021 - Report Presentation First Quarter Results 2021 - Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, April 26, 2021. A live audio webcast of the conference call will be available through the link below. Q1 2021 – First quarter 2021 results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV and images Click here for Mr. Bhattacharya's CV and images

Visit our interactive results hub for more on our financial and sustainability performance over the past quarter, including the latest version of our dynamic Lives Improved world map.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and well-being, and enabling better outcomes across the health continuum – from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips generated 2020 sales of EUR 19.5 billion and employs approximately 77,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements These factors include but are not limited to: changes in industry or market circumstances; economic, political and societal changes; Philips’ increasing focus on health technology and solutions; the successful completion of divestments such as the disentanglement and divestment of our Domestic Appliances businesses; the realization of Philips’ objectives in growth geographies; business plans and integration of acquisitions; securing and maintaining Philips’ intellectual property rights, and unauthorized use of third-party intellectual property rights; COVID-19 and other pandemics; breaches of cybersecurity; IT system changes or failures; the effectiveness of our supply chain; challenges to drive operational excellence, productivity and speed in bringing innovations to market; attracting and retaining personnel; future trade arrangements following Brexit; compliance with regulations and standards including quality, product safety and data privacy; compliance with business conduct rules and regulations; treasury risks and other financial risks; tax risks; costs of defined-benefit pension plans and other post- retirement plans; reliability of internal controls, financial reporting and management process. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see also the Risk management chapter included in the Annual Report 2020.

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include: statements made about our strategy; estimates of sales growth; future Adjusted EBITA; future restructuring and acquisition-related charges and other costs; future developments in Philips’ organic business; and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

Philips has taken a provision of EUR 250 million related to precautionary actions to address a component quality issue, which is Philips’ current best estimate for the expected related costs. The actual amounts of the costs, are dependent on a number of factors the outcome of which is uncertain, and, as a consequence, the amount of the provision may change at a future date.

Third-party market share data

Statements regarding market share, contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, market share statements may also be based on estimates and projections prepared by management and/or based on outside sources of information. Management's estimates of rankings are based on order intake or sales, depending on the business.

Market Abuse Regulation

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Use of non-IFRS information

In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-IFRS financial measures. These non-IFRS financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Further information on non-IFRS measures can be found in the Annual Report 2020.

Fair value information

In presenting the Philips Group’s financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2020. In certain cases independent valuations are obtained to support management’s determination of fair values.

Presentation

All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2020.

In 2020, Philips revised the definition of net finance expenses used in the calculation of Adjusted income from continuing operations attributable to shareholders, to exclude fair value movements of limited life fund investments recognized at fair value through profit and loss. This change leads to more relevant information as the fair value movements are not indicative of Philips' performance. The fair value movements do not represent cash items. Philips believes making this change is helpful for investors to evaluate Philips' performance.

Per share and weighted average share calculations have been adjusted for all periods presented to reflect the issuance of shares for the share dividend in respect of 2019.

As announced on March 25, 2021, Philips has signed an agreement to sell its Domestic Appliances business. As of the first quarter of 2021, the Domestic Appliances business is presented as a discontinued operation. In this report, comparative results have been restated to reflect the treatment of the Domestic Appliances business as a discontinued operation. Further details of the restatement have been published on the Philips Investor Relations website and can be accessed here.

Prior-period amounts have been reclassified to conform to the current-period presentation; this includes immaterial organizational changes.

Thema's

Contact

Steve Klink

Philips Global Press Office Tel: +31 6 10888824

You are about to visit a Philips global content page

Continue

Martijn van der Starre

Philips Global Press Office Tel: +31 6 2847 4617

You are about to visit a Philips global content page

ContinueBusiness Highlights Q1 2021

Strong traction for Philips’ diagnostic and therapeutic catheter portfolio, resulted in a return to double-digit growth for the Image-Guided Therapy Devices business in the quarter.

Philips signed multiple new long-term strategic partnerships in North America, Europe, Asia and Spain.

Philips produced its 100 millionth OneBlade, just 5 years after its launch in 2016. The Philips OneBlade has disrupted shaving markets worldwide, creating a new category for shaving, trimming and edging.