23 oktober 2017

Philips maakt cijfers derde kwartaal 2017 bekend

Philips behaalt in het derde kwartaal een omzet van EUR 4,1 miljard, met een groei van 4% op vergelijkbare basis; het nettoresultaat uit doorlopende activiteiten stijgt naar EUR 263 miljoen, mede dankzij een verbetering van de gecorrigeerde EBITA met 12% naar EUR 532 miljoen

Kerncijfers derde kwartaal Frans van Houten, CEO: We hebben de overname van Spectranetics afgerond, zijn het integratieproces uitstekend gestart, en hebben Stellarex in de Verenigde Staten op de markt gebracht nadat we toestemming hadden gekregen van de Amerikaanse Food & Drug Administration (FDA). Stellarex is de vernieuwende Drug Coated Balloon (DCB) voor de behandeling van patiënten met perifeer arterieel vaatlijden (PAV). De meest recente resultaten van ILLUMENATE, een lopend gerandomiseerd klinisch onderzoek in Europa, hebben aangetoond dat Stellarex de eerste lage-dosisballon* is die na twee jaar een structureel behandelingseffect oplevert, vergeleken met de huidige standaard endovasculaire behandeling in de Verenigde Staten. We streven naar de levering van hoogwaardige en innovatieve producten en oplossingen en hebben aanzienlijke investeringen gedaan om naleving van de Quality Management System Regulation te verbeteren, waarbij belangrijke vooruitgang is geboekt. Hoewel de recente ‘consent decree’ (maatregel) als gevolg van inspecties in en vóór 2015 die met name gericht waren op onze productie van defibrillatoren in de VS teleurstellend te noemen is, blijven we de ingeslagen weg naar verbetering vol vertrouwen vervolgen. MSCI, een toonaangevende samensteller van onderzoeksgebaseerde indices en analyses, heeft de aandelen van Philips van de industriële sector overgebracht naar de gezondheidszorgsector. Dit is opnieuw een erkenning van de omvorming van Philips tot marktleider op het gebied van gezondheidstechnologie. Dit volgt op de herindeling door de Industry Classification Benchmark (ICB) van de FTSE Group van onze aandelen bij de zorgsector, en de gewijzigde indeling van onze onderneming in de categorie ‘gezondheidszorg’ door de STOXX Europe 600 Index. Ondanks aanhoudende wereldwijde onzekerheden blijven onze vooruitzichten voor 2017 ongewijzigd. Gesteund door een vergelijkbare groei van onze orderontvangst in de eerste negen maanden met 5%, liggen we op koers om onze doelstellingen te realiseren van 4-6% groei van de vergelijkbare omzet en een verbetering van de gecorrigeerde EBITA-marge met circa 100 basispunten per jaar.” * ‘Lage dosis’ verwijst hier naar een ballon die een dosis van het geneesmiddel paclitaxel van slechts 2 microgram per vierkante millimeter afgeeft, een hoeveelheid die lager is dan de dosis die wordt afgegeven door sommige andere op de markt verkrijgbare ballons. Business segments In the third quarter, all business segments delivered growth and improved profitability. In the Connected Care & Health Informatics businesses, comparable sales increased by 8%, driven by double-digit growth in Patient Care & Monitoring Solutions. The Adjusted EBITA margin was 440 basis points higher than in the same period last year, mainly driven by higher volume in Patient Care & Monitoring Solutions and productivity savings. Comparable order intake increased by 1%, reflecting the unevenness of the orderintake dynamics. The 5% comparable sales growth of the Personal Health businesses was driven by high-single-digit growth in Sleep & Respiratory Care and mid-single-digit growth in Domestic Appliances; the Adjusted EBITA margin improved by 130 basis points. In the Diagnosis & Treatment businesses, comparable order intake increased by 7%, driven by Ultrasound and Image-Guided Therapy. Sales grew 2% on a comparable basis, while the Adjusted EBITA margin improved by 40 basis points. Philips’ ongoing innovation drive resulted in the following highlights in the quarter: Cost savings Philips’ productivity programs are well on track to deliver annual savings of EUR 400 million, with year-to-date savings of EUR 350 million. In the quarter, procurement savings amounted to EUR 77 million, led by the DfX program, while other productivity programs generated savings of EUR 69 million. Capital Allocation Philips started the EUR 1.5 billion share buyback program in the third quarter of 2017 and intends to complete it in two years. As the program was initiated for capital reduction purposes, Philips intends to cancel all of the shares acquired under the program. Details about the transactions can be found here. Philips successfully placed EUR 500 million floating-rate notes due 2019 and EUR 500 million fixed-rate notes due 2023. The net proceeds of the offering were used for the refinancing of the EUR 1.0 billion loan which was entered into for the purpose of financing the acquisition of Spectranetics and for general purposes. Regulatory update This month, Philips reached agreement with the US government on a consent decree focusing primarily on its defibrillator manufacturing in the US. Philips is fully prepared to fulfill the terms of the decree. As expected, the FDA conducted an inspection of Philips’ Cleveland facility in the quarter. In accordance with normal practice, Philips submitted its response to the inspectional findings for review by the FDA. Philips Lighting As of September 30, 2017, Philips’ shareholding in Philips Lighting was 41.27% of the issued and outstanding share capital. Philips continues to consolidate Philips Lighting. As loss of control is highly probable within one year due to further sell-downs, Philips Lighting is presented as a discontinued operation in the financial statements of Philips as of the second quarter of 2017. Full details about the financial performance of Philips Lighting in the third quarter were published on October 19, 2017. The related report can be accessed here. Third Quarter Results 2017 - Quarterly Report Presentation Third Quarter Results 2017 - Quarterly Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, October 23, 2017. A live audio webcast of the conference call will be available through the link below. Q3 2017 - Third Quarter 2017 Results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV Click here for Mr. Bhattacharya's CV

“De resultaten van Philips in het derde kwartaal laten zien dat we op schema liggen met onze plannen. De vergelijkbare omzet is met 4% gestegen, een resultaat dat te danken is aan tweecijferige groei in onze groeiregio's, met name in China, en een groei van 8% van onze Connected Care & Health Informatics-activiteiten. De gecorrigeerde EBITA is met 140 basispunten verbeterd, voornamelijk als gevolg van hogere volumes, en een programma voor besparingen van kostenproductiviteit dat goed op schema ligt. Bovendien realiseerden we een solide vergelijkbare groei van de orderontvangst van 5% in vervolg op de groei van de orderontvangst van 8% in het derde kwartaal vorig jaar, waarmee de ingezette lijn werd voortgezet.

Quarterly Report

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips' health technology portfolio generated 2016 sales of EUR 17.4 billion and employs approximately 73,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments, including the merger with Spectranetics. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include but are not limited to: global economic and business conditions; developments within the euro zone; the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; the ability to develop and market new products; changes in legislation; legal claims; changes in currency exchange rates and interest rates; changes in tax rates; pension costs and actuarial assumptions; changes in raw materials prices; changes in employee costs; the ability to identify and complete successful acquisitions, and to integrate those acquisitions into the business, including Spectranetics; the ability to successfully exit certain businesses or restructure the operations; the rate of technological changes; political, economic and other developments in countries where Philips operates; industry consolidation and competition; and the state of international capital markets as they may affect the timing and nature of the disposal by Philips of its remaining interests in Philips Lighting. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forwardlooking statements, see the Risk management chapter included in the Annual Report 2016. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-GAAP information In presenting and discussing the Philips Group financial position, operating results and cash flows, management uses certain non-GAAP financial measures. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-GAAP measures to the most directly comparable IFRS measures is contained in this document. Further information on non-GAAP measures can be found in the Annual Report 2016. Comparable order intake and Adjusted EBITDA are measures included to enhance comparability with other companies. Use of fair-value measurements In presenting the Philips Group financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2016 and Semi-Annual Report 2017. Independent valuations may have been obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2016, unless otherwise stated. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Thema's

Contact

Ben Zwirs

Philips Global Press Office Tel: +31 6 1521 3446

You are about to visit a Philips global content page

Continue

Steve Klink

Philips Global Press Office Tel: +31 6 10888824

You are about to visit a Philips global content page

ContinueBusiness Highlights Q3 2017

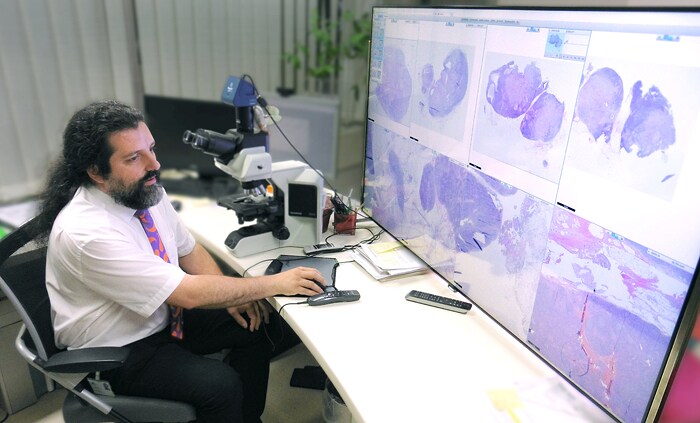

Philips supports global transformation of pathology with two new fully digitized labs in Austria

Philips introduces new OB/GYN ultrasound innovations at ISUOG 2017

Treasure your heart with healthy, homemade food this World Heart Day, 29th September