Le 24 janvier 2017

Les résultats du quatrième trimestre et le bilan 2016

Au quatrième trimestre, Philips a enregistré une hausse de 19% de son EBITA ajusté à 1 milliard EUR, un résultat net de 640 millions EUR et un chiffre d'affaires de 7,2 milliards EUR, moyennant une progression de 5% de son pôle HealthTech Au quatrième trimestre, Philips a enregistré une hausse de 19% de son EBITA ajusté à 1 milliard EUR, un résultat net de 640 millions EUR et un chiffre d'affaires de 7,2 milliards EUR, moyennant une progression de 5% de son pôle HealthTech

Chiffres clés du quatrième trimestre Faits marquants de l'année entière Frans van Houten, CEO : « Les résultats de notre portefeuille HealthTech au quatrième trimestre 2016 révèlent que notre orientation stratégique porte ses fruits. Je me réjouis de constater la croissance de 5% du chiffre d'affaires comparable et la progression de 190 points de base de la marge d'EBITA ajustée à 15,3%, accompagnées d'une croissance et une amélioration des marges dans tous les segments de notre portefeuille HealthTech. Sur l’ensemble de l'année, la croissance du chiffre d'affaires comparable du portefeuille HealthTech a aussi atteint 5%, alors que la marge d'EBITA ajustée affiche une amélioration soutenue. À l'échelle du groupe, la croissance de 3% du chiffre d'affaires comparable au quatrième trimestre et les améliorations opérationnelles se sont traduites par une progression de 190 points de base de la marge d'EBITA ajustée. Dans l'ensemble, 2016 a été une année décisive qui nous a vus franchir des étapes stratégiques importantes dans la transformation de Philips en leader des technologies de la santé, sans oublier le succès de l’entrée en Bourse de Philips Lighting et la perspective d’un avenir florissant pour les activités combinées de Lumileds et Automobile. Sur le plan opérationnel, nous avons réalisé des progrès significatifs avec un chiffre d'affaires comparable en hausse de 3% sur l’année entière, une amélioration de la marge d'EBITA ajustée de l’ordre de 130 points de base et un flux de trésorerie d'exploitation de 1,9 milliard EUR pour le groupe Philips. La puissance de nos solutions a entraîné une forte expansion de nos partenariats stratégiques à long terme : nous avons conclu 15 nouveaux contrats pluriannuels d’une valeur totale d'environ 900 millions d'euros. J’entrevois beaucoup de perspectives de croissance pour Philips qui cerne bien les besoins des professionnels de la santé et des consommateurs en vue d’offrir à ses clients des solutions innovantes en matière de soins. Philips s’est métamorphosée en leader mondial des technologies de la santé. L'Industry Classification Benchmark du FTSE Group ne s'y est pas trompée puisqu’il a revu récemment le classement de notre action, qui figure désormais dans la catégorie « Health Care Industry ». Des règles et des normes différentes s’appliquent à nos produits et services connexes. La qualité est notre credo : ces dernières années, nous avons consenti d’énormes investissements pour réaliser des avancées dans ce domaine. À l'heure actuelle, nous sommes en pourparlers avec le département américain de la Justice, représentant la FDA, à la suite d’inspections menées durant et avant 2015, notamment concernant nos activités aux États-Unis dans le domaine des défibrillateurs externes. Les négociations n'ont pas encore abouti, mais nous nous attendons à un impact significatif sur les activités dans ce secteur. HealthTech “Our Accelerate! transformation program continued to deliver operational improvements across our businesses. We are pleased that our growth initiatives - such as the successful integration of Volcano - continue to pay off, contributing to the 5% comparable sales growth and significant margin expansion across all our segments.” In the fourth quarter, the Personal Health businesses grew by 7% on a comparable basis, with growth across the portfolio, led by double-digit growth in Health & Wellness and high-single-digit growth in Domestic Appliances; the Adjusted EBITA margin improved by 100 basis points. The Diagnosis & Treatment businesses posted comparable sales growth of 3%, and the Adjusted EBITA margin improved by 280 basis points, driven by Image-Guided Therapy and Diagnostic Imaging. In the Connected Care & Health Informatics businesses, comparable sales increased 4%, driven by mid-single-digit growth in Patient Care & Monitoring Solutions and Population Health Management, and the Adjusted EBITA margin improved by 50 basis points. Following strong equipment-order intake growth in the third quarter, order intake in the fourth quarter on a currency-comparable basis was in line with 2015’s very strong fourth quarter, as expected by the company. Of the various long-term strategic partnership agreements that were signed in the fourth quarter, Philips only includes near-term business in the calculation of the order intake, as per company policy. Philips Lighting In the fourth quarter, Adjusted EBITA improved by 180 basis points to 9.8% of sales, while comparable sales declined by 3% and free cash flow amounted to EUR 272 million. Full details about the financial performance of Philips Lighting in the fourth quarter were published on January 23, 2017. The related report can be accessed here. Following the listing of Philips Lighting in Amsterdam, Philips holds a 71.225% stake with the aim of fully selling down over the next several years. As the majority shareholder in Philips Lighting, Philips continues to consolidate the financial results of Philips Lighting. Philips Group Other Group cost savings In the fourth quarter, overhead cost savings amounted to EUR 47 million, the Design for Excellence (DfX) program generated EUR 163 million of incremental procurement savings, and the End2End process improvement program achieved EUR 52 million in productivity gains. In 2016, the three cost savings programs all delivered ahead of plan. The company achieved EUR 269 million of gross savings in overhead costs, EUR 418 million of gross savings in procurement, and EUR 204 million of productivity savings from the End2End program. Sale of Lumileds & Automotive Philips has signed an agreement to sell an 80.1% interest in the combined Lumileds and Automotive businesses to certain funds managed by affiliates of Apollo Global Management, LLC. Philips will retain the remaining 19.9% interest. The transaction is expected to be completed in the first half of 2017, subject to customary closing conditions, including the relevant regulatory approvals. Miscellaneous On December 20, 2016, Philips announced its intention to redeem the outstanding 5.750% Notes due 2018 with an aggregate principal amount of USD 1.25 billion. The transaction was completed on January 20, 2017 and resulted in a charge in the fourth quarter of 2016 of USD 66 million (EUR 62 million), reflected in the Financial income and expenses line on the income statement. The cash outflow in the first quarter of 2017 will be USD 1,314 million (approximately EUR 1,247 million) excluding accrued interest. The transaction contributes to Philips’ plan to reduce its annual interest expenses by approximately EUR 100 million. Fourth quarter and Annual Results 2016 - Quarterly Report Presentation Fourth quarter and Annual Results 2016 - Quarterly Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, January 24, 2017. A live audio webcast of the conference call will be available through the link below. Q4 2016 - Fourth quarter 2016 results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV and images Click here for Mr. Bhattacharya's CV and images

Quarterly Report

About Royal Philips

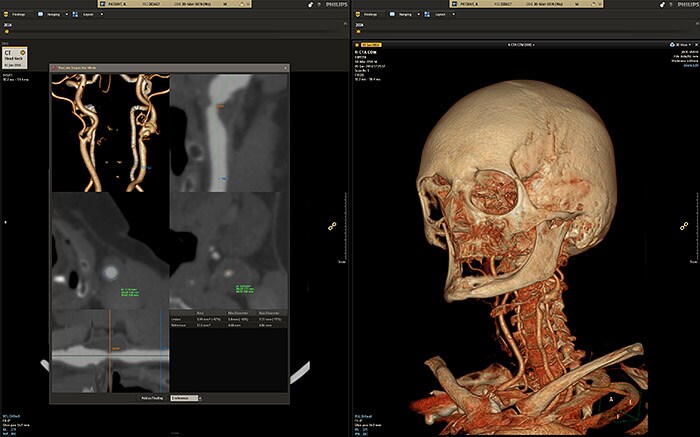

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips' health technology portfolio generated 2016 sales of EUR 17.4 billion and employs approximately 71,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Royal This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include but are not limited to: domestic and global economic and business conditions; developments within the euro zone; the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; the ability to develop and market new products; changes in legislation; legal claims; changes in exchange and interest rates; changes in tax rates; pension costs and actuarial assumptions; raw materials and employee costs; the ability to identify and complete successful acquisitions, and to integrate those acquisitions into the business; the ability to successfully exit certain businesses or restructure the operations; the rate of technological changes; political, economic and other developments in countries where Philips operates; industry consolidation and competition; and the state of international capital markets as they may affect the timing and nature of the dispositions by Philips of its interests in Philips Lighting and the combined Lumileds and Automotive businesses. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2015. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-GAAP information In presenting and discussing the Philips Group financial position, operating results and cash flows, management uses certain non-GAAP financial measures. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-GAAP measures to the most directly comparable IFRS measures is contained in this document. Further information on non-GAAP measures can be found in the Annual Report 2015. Use of fair-value measurements In presenting the Philips Group financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2015. Independent valuations may have been obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2015, unless otherwise stated. Prior-period financial statements have been restated to reflect a reclassification of net defined-benefit post-employment plan obligations to Long-term provisions in accordance with the accounting policies as stated in the Semi-annual Report of 2016. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.Article 7(1) of the EU Market Abuse Regulation.

Forward-looking statements

Sujets

Contact

Ben Zwirs

Philips Global Press Office Tel: +31 6 1521 3446

You are about to visit a Philips global content page

Continue

Steve Klink

Philips Global Press Office Tel: +31 6 10888824

You are about to visit a Philips global content page

ContinueBusiness highlights Q4 2016